The adjustment process may include adding missing transactions, deleting duplicates, or modifying transaction amounts to reflect the accurate financial picture. QuickBooks Online provides tools and reports to streamline this correction process, facilitating a smooth and accurate reconciliation. This action triggers the ‘Delete Bank Reconciliation’ feature, allowing you to make adjustments and rectify any discrepancies in the reconciled transactions. Once the ‘Delete’ button is clicked, a confirmation prompt appears, ensuring that the user can confirm the deletion before proceeding. I also added a link to give more insights about unreconciling transactions. I recommend consulting with your accountant before performing any of the steps.

Categorization errors

Here’s an article you can read more about undoing reconciliations in QuickBooks Online. For other recommended solutions, see Resolve reconciliation differences. It has tips that can help hunt down tricky transactions and get the difference to equal zero.

Connect your payroll software

I understand the importance of undoing a reconciliation in QuickBooks. I have actually seen this method and used it in the past and I beleive Intuit might have updated the software and now the action column is not visible. Reconciliation in QuickBooks Online is essential for businesses to maintain financial integrity and ensure seamless operations. They force you to pay someone just to unreconcile something? This is the most ridiculous pile of dog doo-doo I’ve ever heard.

Step 3: Click on the ‘Delete’ Button

We believe everyone should be able to make financial decisions with confidence. See articles customized for your product and join our large community of QuickBooks users. As mentioned by my colleague above, you can undo the entire period at once using QuickBooks Online Accountant. At the moment, the ability to permit the admin level is unavailable in QBO. I can see how the functionality would be beneficial to your business.

Step 1: Make sure you have everything needed to reconcile in QuickBooks

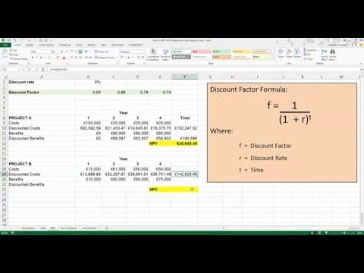

This critical task plays a pivotal role in maintaining financial accuracy and compliance. By verifying that all financial transactions are recorded correctly, it helps in avoiding discrepancies and errors that may arise. The beginning balance amount should correspond to the amount on your bank statement for the same start date.

How to unreconcile a monthly statement that has already by reconciled?

Her work has appeared in the Miami Herald and USA Today. Amrita has a master’s degree in journalism from the University of Missouri. Our partners cannot pay https://www.accountingcoaching.online/the-dividend-tax-rate-for-2019-2020-2-2/ us to guarantee favorable reviews of their products or services. Once you’re done, you should see a difference of $0, which means your books are balanced.

A reconciliation of a bank or credit card account compares the statement to what is in QuickBooks. This is the same idea as balancing an account and checkbook in more manual times. To carry out cumulative preferred stock: definition how it works and example a reconciliation, you will need to have your monthly bank or credit card statements on hand. On the QuickBooks desktop application, you can undo an entire reconciliation in a single step.

- In register view – uncheck every R that was in the reconciliation, which reinforces importance of printing a recon detail report each and every time.

- QuickBooks Online is an easy-to-use, convenient accounting software with nearly 29 million users in the US alone.

- You’ll also want to eventually add users as part of your setup.

- We believe everyone should be able to make financial decisions with confidence.

- It’s crucial to carefully review each transaction, match them with the corresponding bank statements, and address any inconsistencies.

To fix the error, let’s unreconcile the $200 and $125 checks and mark the $325 check as reconciled. To unmark a reconciled transaction, click anywhere on the entry, click R until it’s blank, and then click the Save button, as shown below. Reconciling your accounts is a critical accounting function in your business and one that should be completed regularly. Although it’s relatively easy to undo reconciliation in QuickBooks Online, doing so should be a rare exception rather than something you do as a regular part of your bookkeeping process.

They have this option to ensure your books are in good shape and to avoid messing up your accounts. Currently, the feature to undo the entire reconciliation is exclusive to accountants with a QBO Accountant subscription. Considering that, you don’t have the Undo option under the Action column on the Reconciliation page. If you have an accountant, you may invite them to your company so they can accomplish this task on your behalf. Following the ‘Undo’ button click, QuickBooks Online will prompt a confirmation dialogue to ensure the intentional initiation of the bank reconciliation undo process.

To minimize the impact, you can only unreconcile one transaction at a time. If you need to completely start over, reach out to your accountant. Once on the Reconcile Page, users can easily locate the specific account they wish to work with using the intuitive navigation features. From there, selecting the ‘Undo Reconciliation’ option allows for a streamlined pathway to reverse reconciled transactions. Deleting a reconciliation in QuickBooks Online necessitates a systematic approach to ensure the accurate removal of previously reconciled transactions and accounts. You can navigate to the ‘Account’ section and select the bank account that requires reconciliation adjustments.

You may be able to unreconcile a single transaction easily, but you cannot re-reconcile that transaction without undoing and re-doing the reconciliation. The option to undo whole reconciliation process in a QuickBooks Online account is unavailable. However, you can only unreconcile one transaction at a time to lessen the damage. Once the correct bank account is selected, proceed to the next step in the process of managing reconciliation adjustments in QuickBooks Online. You will be asked to confirm whether you want to undo the Previous Reconciliation and proceed with the Bank Reconciliation adjustments.

This can help pinpoint where exactly the issue lies and what needs to be corrected. By following these troubleshooting steps diligently, you’ll be able to identify and resolve any reconciliation problems efficiently in QuickBooks Desktop. This feature is particularly beneficial for https://www.simple-accounting.org/ accountants and bookkeepers who need to correct errors or make adjustments to previously reconciled transactions. The platform offers a user-friendly interface and clear step-by-step guidance, streamlining the entire undo process and maintaining the integrity of financial records.

You can change some of this information without redoing the entire reconciliation (except for the date), but if you want your records to be 100% accurate, it’s worth going through the effort. If you’re using Rewind Backups for QuickBooks Online (nice choice) and need to perform an Advanced Restore, you also may need to undo reconciliations in your company files. Another way to confirm the action is to click on the Reconcile button in the bank register.

Click on Transactions in the left navigation menu and then select Chart of accounts. See our overall favorites, or choose a specific type of software to find the best options for you. Now, open the register for the account you are un-reconciling by hovering over Accounting on the left-side toolbar and then selecting Chart of Accounts. When the Chart of Accounts appears, click View Register.

If you reconciled a transaction by mistake, here’s how to unreconcile it. If you adjusted a reconciliation by mistake or need to start over, reach out to your accountant. If you’re reconciling an account for the first time, review the opening balance. It needs to match the balance of your real-life bank account for the day you decided to start tracking transactions in QuickBooks. If you’ve identified any errors on the statement, contact your financial institution at once so they can investigate.